Last Updated on February 12, 2024 by Archie Biggs

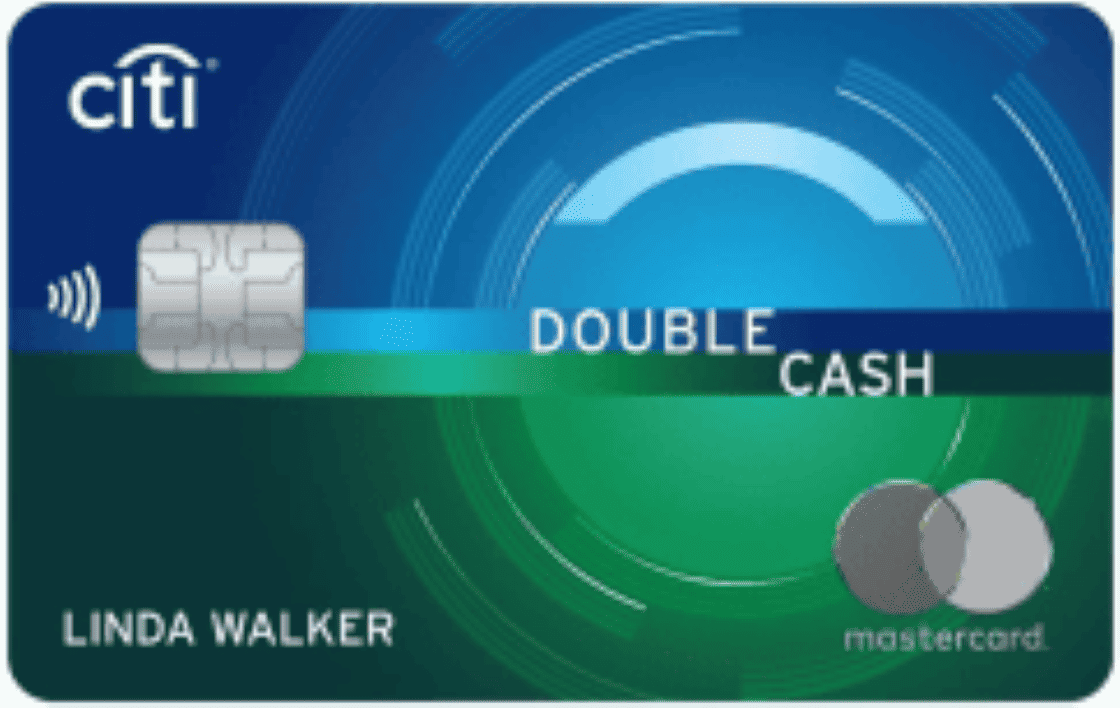

Best for Up to 2% Cash Back

Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases

Plus - Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be 18.74% - 28.74%, based on your creditworthiness.

Card Details

- Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases.

- Earn $200 Bonus cash back after spending $1500 on purchases in the first 6 months of account opening.

- To earn cash back, pay at least the minimum due on time.

- Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be 19.24% – 29.24%, based on your creditworthiness.

- Balance Transfers do not earn cash back. Intro APR does not apply to purchases.

- If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance (including balance transfers) by the due date each month.

- There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

- Select “Apply Now” to learn more about the product features, terms and conditions

- View Rates and Fees

Citi® Double Cash Card Details

| Purchase Intro APR | Balance Transfer APR | Regular APR | Annual Fee | Credit Needed |

|---|---|---|---|---|

| N/A | 0% intro APR on balance transfers for 18 months |

19.24% – 29.24% (Variable) | $0 | Good, Excellent |

How the Citi® Double Cash Card Stacks Up

Pros

Cons

Generous Cash Back Rewards

The Citi Double Cash Card offers a generous flat cash back rate, allowing you to earn up to 2 percent cash back on every purchase you make, without any spending caps. This makes it an ideal option for those who want to maximize their rewards without worrying about hitting a limit.

No Annual Fee and $0 Liability on Unauthorized Charges

Another great feature of the Citi Double Cash Card is that it comes with no annual fee, allowing you to earn cash back rewards without any additional fees. Additionally, the card provides $0 liability on unauthorized charges, giving you peace of mind and security.

Foreign Transaction Fees

Another potential drawback of the Citi Double Cash Card is its 3 percent foreign transaction fee, making it a poor choice for international travelers. If you frequently travel abroad, you may want to consider a card with no foreign transaction fees to save money.

Lengthy Introductory APR on Balance Transfers

If you have high-interest balances on other credit cards, the Citi Double Cash Card can help you save big on interest charges. The card offers an 18-month introductory 0 percent APR on balance transfers, providing you with ample time to pay off your balances without any interest charges. After the intro period, the ongoing APR is reasonable at 19.24 percent to 29.24 percent variable APR

Relatively low APR vs other cards

-

Ongoing 19.24 percent to 29.24 percent (variable) APR can be quite low compared to many other balance transfer cards

No Introductory APR on New Purchases

Unlike some of its competitors, the Citi Double Cash Card doesn’t provide an introductory APR on new purchases. This means that you won’t get a break on interest charges if you carry a balance on new purchases.

Penalty APR

Finally, the Citi Double Cash Card has a potential 29.24 percent penalty APR, which can be expensive if you make a late payment. Therefore, it’s crucial to make your payments on time to avoid this penalty.

Bottom Line

Looking for a cash back credit card that is simple and flexible with generous rewards? The Citi® Double Cash Card offer is the perfect choice for you. With no annual fee, this card offers a flat-rate of 2% cash back on all purchases with no limits to how much cash back you can earn. Plus, you can transfer your high-interest balances from other credit cards with a top-tier intro APR on balance transfers, making it easy to save on interest charges.

While there are other cash back credit cards on the market, the Citi® Double Cash Card offer stands out from the crowd. Its unique double cash back rewards structure and simple, no-fuss rewards program make it an excellent choice for anyone who wants to earn rewards without the hassle of tracking rotating categories or complicated bonus structures.

Whether you’re looking for an everyday spend card or a way to earn cash back on your balance transfers, the Citi® Double Cash Card offer is a solid choice. With its practical cash back rewards and generous intro APR offer, it’s a great option for anyone who wants to earn rewards while practicing financial responsibility.

So, if you’re ready to start earning cash back rewards on every purchase you make and save big on interest charges, apply for the Citi® Double Cash Card offer today!

Check card Rates & Fees

Our SMART SCORE is based on a variety of factors in which the credit

card issuers have no input or influence on how we rate credits cards listed on our site.