Last Updated on March 7, 2024 by Archie Biggs

Understanding Citibank

Citibank is an integral part of Citigroup Inc., a globally recognized American multinational financial services corporation that calls New York City its home. Commanding its position amongst the esteemed “Big Four” banking institutions in the United States, Citibank proudly presents an expansive and versatile portfolio of financial solutions. Their offerings span the essential checking and savings accounts, extend into the realms of personal and commercial loans, and embrace the sophistication of wealth management and investment services. However, Citibank is particularly renowned for its extensive collection of credit cards, designed meticulously to cater to diverse lifestyle needs and spending habits.

Unraveling the Credit Card Services Offered by Citibank

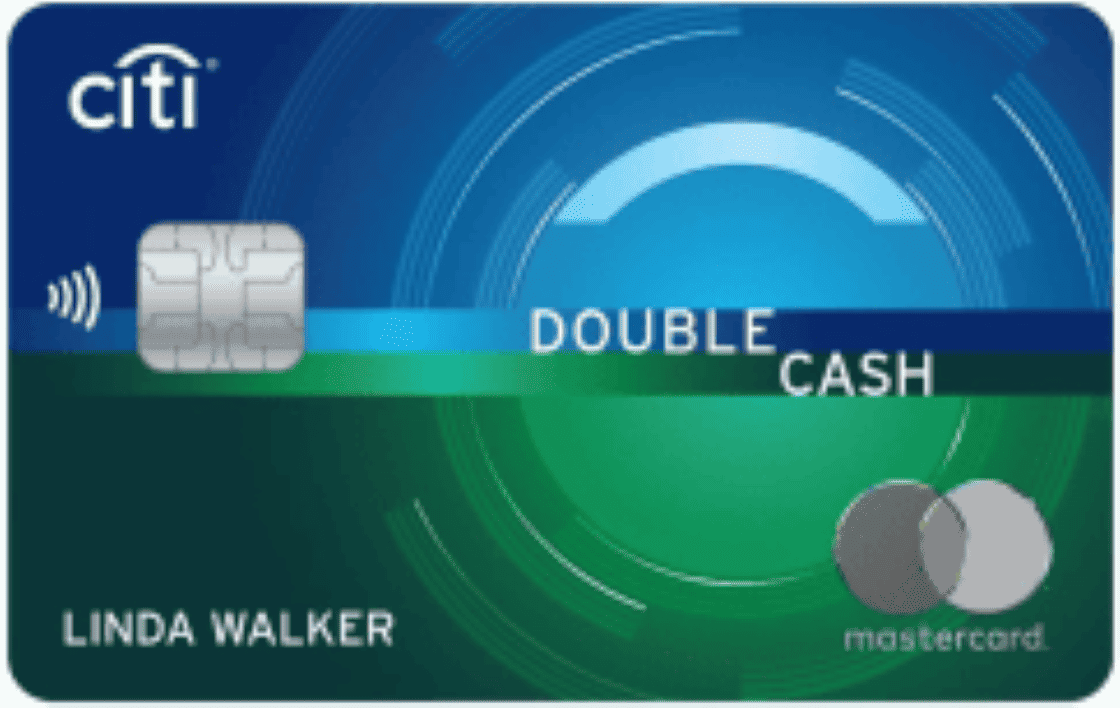

One of Citibank’s most commendable feats is its comprehensive array of credit cards, carefully crafted to accommodate a multitude of customer requirements. These cards are tailored to complement various lifestyles and spending habits, offering benefits such as cash back, travel rewards, and points for everyday purchases. Notable examples of Citibank’s card offerings include the Citi® Double Cash Card, Citi® Simplicity Card, Citi® Rewards+ Card, Citi® Premier Card, and the Citi® Prestige Card, each with its unique rewards structure and perks.

What Makes the ‘Best’ Citibank Credit Card?

The definition of the ‘best’ Citibank credit card is largely subjective, varying greatly with individual needs and spending patterns. As of my knowledge cutoff in September 2021, the Citi® Double Cash Card is often deemed one of the best. Why? Its rewards structure is simple yet effective, offering 2% cash back on all purchases—1% when you buy, and another 1% as you pay back those purchases. This unique structure makes it a strong contender for everyday use.

Pros and Cons of Citibank Credit Cards: The Two Sides of the Coin

Pros:

Variety: With a plethora of cards to suit different lifestyle needs, including travel, cash back, and everyday spending, Citibank is truly a master of diversity.

Rewarding Loyalty: Citibank’s rewards program allows customers to earn points on purchases, which can be redeemed for a variety of rewards.

Generous Introductory Offers: Many Citibank cards come with introductory offers like low or 0% APR for a certain period, or bonus points after meeting a spending threshold.

Cons:

High-Interest Rates: Once the introductory period ends, the APR can soar, particularly for those with less-than-ideal credit scores.

Complex Rewards: Some cards have a tiered or rotating rewards system that might require meticulous tracking to maximize benefits.

Potential for Fees: Some cards come with annual fees, foreign transaction fees, and other costs that can accumulate if not managed prudently.

Making the Right Choice: How to Choose a Citibank Credit Card

Choosing a Citibank credit card requires a systematic approach—first, identify your spending habits. Are you spending heavily on specific categories like travel or dining? Consider a card that offers bonus rewards in those areas. Then, take your lifestyle into account. If you frequently travel, a card with travel benefits like lounge access or no foreign transaction fees might come in handy. Finally, evaluate the fees versus the rewards. Some cards come with annual fees, but if you use the card regularly and strategically, the benefits or rewards could potentially outweigh the costs.

Top-Notch Perks of a Citibank Credit Card

As a Citibank cardholder, you’re in for a treat! Citi® cardholders get exclusive access to purchase tickets to thousands of events annually, including presale tickets and VIP packages to concerts, sporting events, and dining experiences, courtesy of Citi® Entertainment. The rewards program is flexible, with points that can be redeemed for various rewards like travel, gift cards, or even statement credits. Certain cards offer additional travel benefits, including complimentary travel insurance, airport lounge access, and no foreign transaction fees.

Credit Score: How It Impacts Your Credit Card Application

Citibank places significant emphasis on your credit score when reviewing your credit card application. A higher score not only improves your chances of approval but also can lead to better terms, like a lower APR. On the flip side, a low score could result in denial or higher interest rates. A score in the ‘good’ to ‘excellent’ range (generally 670 and above) bolsters your chances for approval with most Citibank cards.

Decoding the Fee Structure of Citibank Credit Cards

Yes, some Citibank credit cards do come with fees. These can include annual fees, late payment fees, cash advance fees, and foreign transaction fees. However, these fees differ depending on the specific card, making it crucial to go through the cardholder agreement with a fine-tooth comb.

Why You Should Consider a Citibank Card

With robust rewards programs, generous introductory offers, and a wide array of perks, Citibank cards greatly enhance your purchasing power and lifestyle. If you’re in the market for a credit card that rewards spending and offers compelling benefits like travel perks or exclusive event access, a Citibank card might just be the perfect fit.

Who Should Consider a Citibank Card

Regular spenders in categories like travel, dining, or everyday purchases should definitely consider a Citibank card. Similarly, those looking to consolidate debt with a balance transfer offer or individuals attracted to robust rewards programs or Citibank’s unique perks should give Citibank cards a serious thought.

Who Should Steer Clear of Citibank Credit Cards

Individuals who rarely use a credit card, have a low credit score, or are not comfortable managing potential fees associated with some cards might want to consider other options. If the rewards categories don’t align with your spending habits, you might find a card from another issuer more beneficial.

Credit Score Prerequisites for a Citibank Credit Card

Generally, a credit score in the ‘good’ to ‘excellent’ range (670 and above) is needed to qualify for most Citibank credit cards. However, this can vary depending on the specific card and other factors like your income and debt-to-income ratio.

Exploring the CitiBank Rewards Program

Citibank’s rewards program, Citi® ThankYou Rewards, allows you to earn points on everyday purchases made with eligible cards. These points can be redeemed for various rewards, including travel, gift cards, shop with points at Amazon.com, payments towards student loans, or even as cash back in the form of a statement credit.

Additional CitiBank Benefits: The Cherry on Top

Besides the robust rewards program, CitiBank also offers benefits like fraud protection, digital wallet compatibility for easy mobile payments, and various travel and purchase protections. Certain cards even grant access to Citi® Private Pass, which provides exclusive access to concerts, sporting events, and more. All these perks make owning a Citibank credit card a rewarding experience.

Citi Bank

Citi Custom Cash℠ Card

Earn unlimited 1% cash back on all other purchases.

Intro Offer - Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back

Get 0% Intro APR for 15 months on purchases and balance transfers

Annual fee - $0

Regular APR - 19.24% - 29.24% (Variable)

Credit Needed - Good, Excellent

Citi® Double Cash Card

Intro Offer - 0% intro APR on balance transfers for 18 months

Annual fee - $0

Regular APR - 19.24% - 29.24% (Variable)

Credit Needed - Good, Excellent

FAQ’s

How do I apply for a CitiBank credit card?

Applying for a CitiBank credit card opens doors to a world of financial opportunities. With a variety of options tailored to your needs, CitiBank offers unparalleled benefits and rewards. This comprehensive guide ensures a seamless application process. Assess your eligibility, gather the necessary documents, and choose the perfect card. With a user-friendly online application, prompt review, and access to exclusive offers, a CitiBank credit card empowers you to take control of your financial journey

What are the benefits of the Citi® Premier Card?

Step into a world teeming with rewards, convenience, and unprecedented freedom with the Citi® Premier Card. This financial powerhouse goes beyond the ordinary, making every purchase an opportunity to earn and enjoy. Beginning with a generous welcome bonus of 60,000 ThankYou® Points after a mere $4,000 expenditure within the first three months, the Citi® Premier Card invites you into a realm where every dollar spent is rewarded.

Think that’s all? Think again. Citi® Premier Card users are privy to an exclusive, limited-time offer, earning 10 ThankYou® Points per $1 on hotel stays, car rentals, and attractions (air travel excluded) via the Citi® Travel℠ portal until June 30, 2024. That’s 10 times the rewards on every dollar spent!

Your daily essentials and indulgences don’t go unnoticed with the Citi® Premier Card. Every dollar spent at Gas Stations, Air Travel, and Other Hotels earns you 3 points. Dine out or shop at supermarkets? That’s another 3 points per dollar. Even all other purchases get you a point per dollar spent, ensuring no expenditure goes unrewarded.

Couple these benefits with the Citi®Premier Card’s Annual Hotel Savings Benefit, no expiration or limit on point accumulation, and zero foreign transaction fees, and you have a credit card that’s not just a financial tool but a lifestyle enhancer.

In essence, the Citi® Premier Card offers more than just tangible benefits; it offers a way of life that values freedom, rewards spending, and celebrates every facet of your lifestyle. It’s not just a card; it’s your key to a world of endless rewards. The Citi® Premier Card, where every purchase is a journey towards greater rewards.

What is the Citi® 5/24 rule?

The Citi® 5/24 rule, while not an official policy, is an important consideration in the credit card world. It refers to an observed pattern where Citibank is likely to reject your card application if you’ve opened five or more personal credit cards across all banks within the last 24 months. The rule does not apply universally across all Citibank cards, with some exceptions noted. By understanding the scope and impact of this rule, you can plan your credit card strategy wisely, potentially avoiding unnecessary rejections that could negatively impact your credit score. Navigating this rule is possible with careful tracking of your credit applications and knowledge of which cards are typically affected.

In essence, the Citi® 5/24 rule, shrouded in myths and misconceptions, is a critical factor in the credit card application process. It emphasizes the importance of mindful financial planning and strategic application to make the most of credit card benefits without negatively affecting your credit profile.

How do I get a credit limit increase on my Citi® card?

Securing a credit limit increase on your Citi® card is a methodical process that requires a robust understanding of your financial standing, encompassing credit score and payment history reviews. Following prescribed steps online for submitting your credit limit increase request is fundamental. The strategy for a successful request includes maintaining a low credit utilization ratio, punctual bill payments, and refraining from frequent credit limit increase requests. Navigating this process is akin to undertaking a carefully mapped journey towards achieving greater financial liberty and adaptability.